Sometimes it pays to think long-term. There's no clearer example of that than index funds.

"One of the advantages of investing in index funds is ensuring that you own the entire market," said Derek Williams, a wealth advisor at

Because of their size, index funds move slowly. But thanks to their diversity, they move more reliably upward than many other investments, at least in the long run. The S&P 500, for example, has gained an average of

But some index funds do even better — much better. Morningstar Direct has revealed the 20 highest-performing index funds of the past decade, and they make it clear that good things come to those who wait.

"These funds have done well because they were leveraged, bullish bets and the stock market winds happened to blow in the direction of these bets," said

At the top of the list is the Grayscale Bitcoin Trust (GBTC), which yielded a 10-year annualized return of 64.03%. This fund is unusually volatile. It tracks

"Grayscale Bitcoin Trust is still showing as the top-performing index fund of the decade even after falling in price by nearly half since its peak in 2021," Williams said. "This shows you that 10-year performance can be misleading when investors are performing research. Many look at long-term returns as the indicator of how a fund will continue to perform over another longer time period, when that could be completely incorrect."

The rest of the funds, like

In second place is the Direxion Daily Technology Bull 3X ETF (TECL), which triples the performance of the Technology Select Sector Index. Over the past decade, Direxion's fund yielded an average of 36.82% per year.

READ MORE:

In the No. 3 spot is the iPath Global Carbon ETN (GRNTF), which tracks the performance of

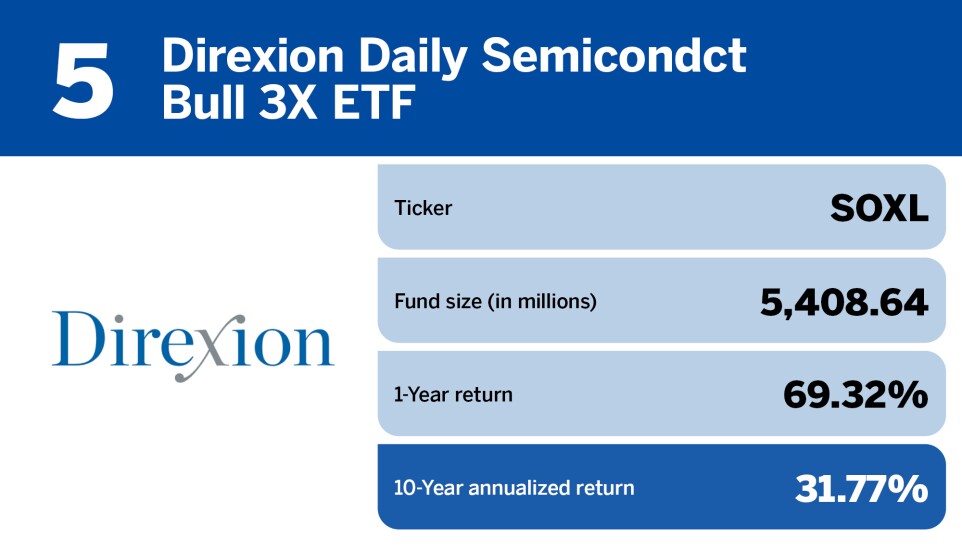

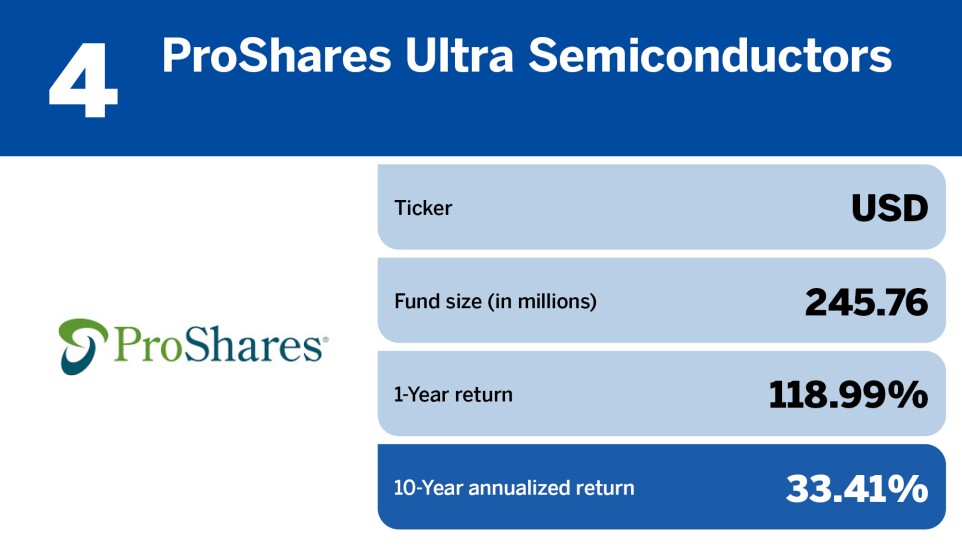

The top five is rounded out by ProShares Ultra Semiconductors (USD), which yielded 33.41%, and Direxion Daily Semiconductor Bull 3X Shares (SOXL), which saw returns of 31.77%. Both funds follow — and multiply — the performance of stocks in

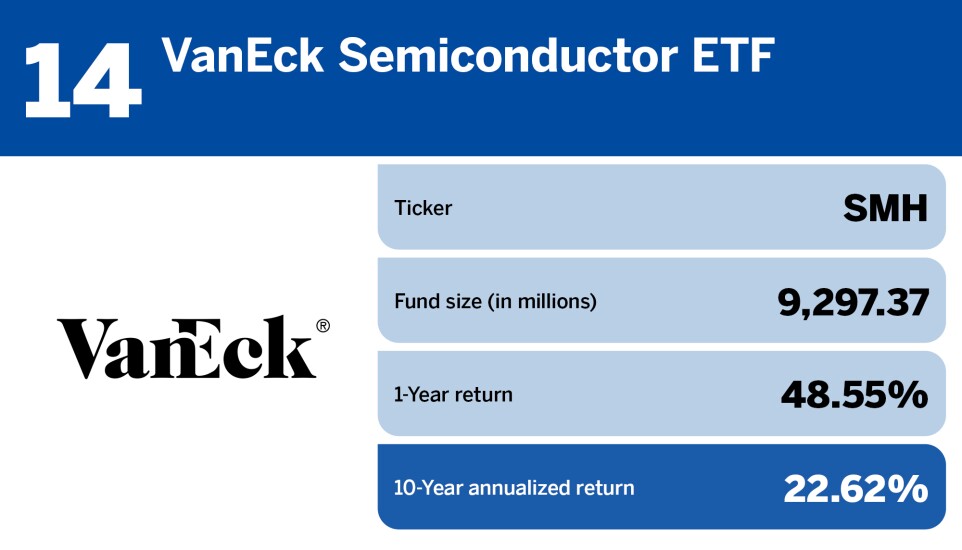

Those last two are no surprise. Over the past decade, semiconductors have become crucial to modern electronics, from smartphones to satellite systems to medical devices. American companies dominate the industry, taking up about half of global market share, according to the

READ MORE:

"The semiconductor funds are all experiencing a meteoric rise in chip stocks, most notably NVIDIA, as AI-related sentiment pushes these stocks much higher," Williams said.

All of these index funds have produced spectacular returns. But as Ahmed pointed out, investing in them is not without risks.

"You need a bullish market to get these outsized returns," he said. "Had the market gone the other way, there would have been substantial heartache and pain for investors in these funds. … Buyer beware."

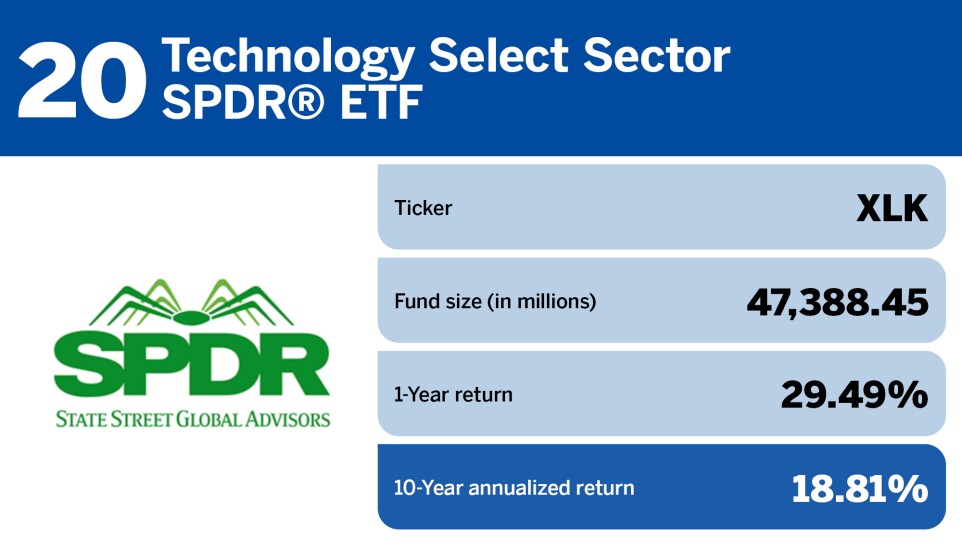

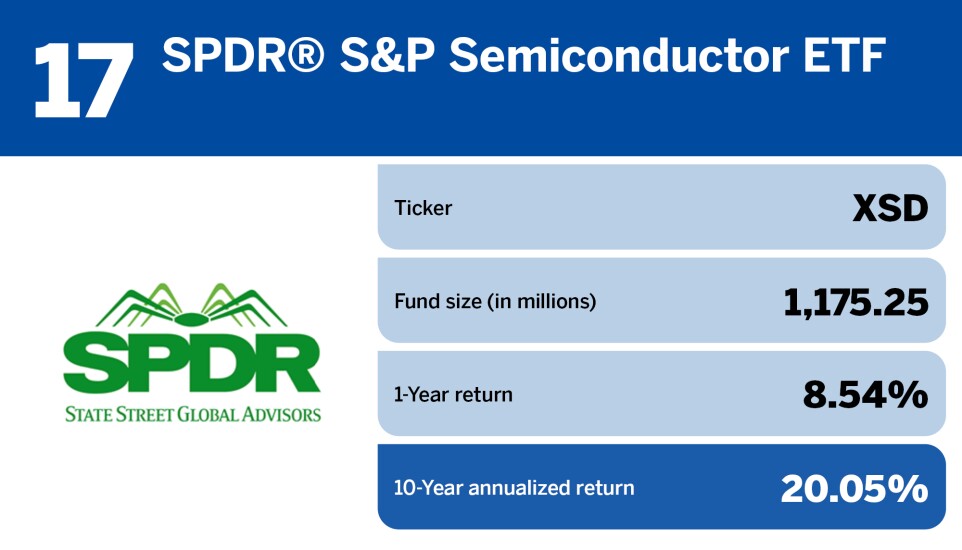

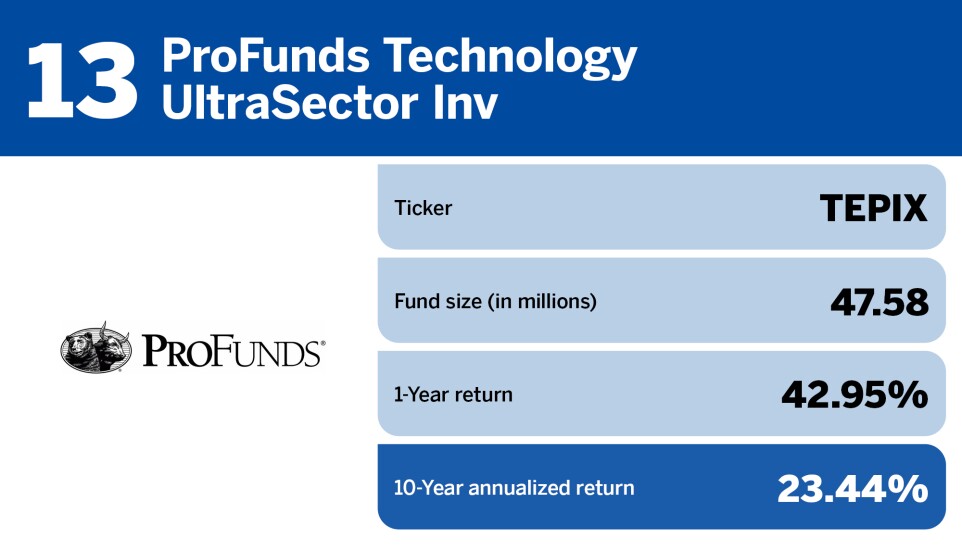

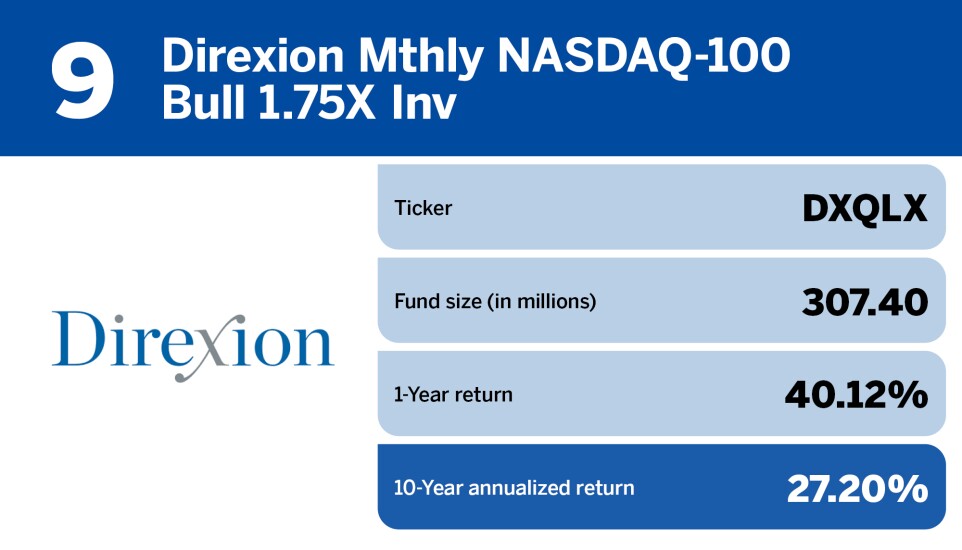

To see the rest of the top 20 index funds of the past 10 years, scroll through the cardshow below. (All data is from Morningstar Direct, and is current as of Nov. 13, 2023.)