Armed with an extra $80 billion in funding for the next decade, the Internal Revenue Service is using the bulk of its war chest to scrutinize taxpayers who make more than $400,000 a year, focusing on high net worth individuals, corporations and partnerships.

That means heightened inspection of the highest earners, whose chances of being audited have swung wildly over the past four years, including a steep annual drop of 75% in 2020, the first year of the pandemic.

IRS Commissioner Daniel Werfel said last month that the agency will audit taxpayers reporting income of les than $400,000

Officials have made no similar statements about using a given historical rate for higher earners. That suggests such taxpayers will bear the brunt of the new scrutiny.

The nation's tax collector traditionally audits federal returns at different rates, based on how much income is reported. It's aiming to reduce what's known as

The IRS's additional $80 billion, of which

Wild swings in audit rates for the wealthy

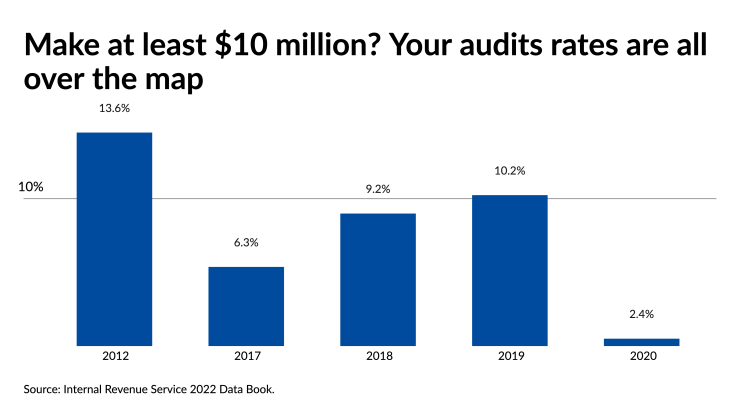

Overall audit rates have been declining for more than a decade. But in recent years, there have been stark year-to-year shifts in rates for higher earners.

In 2012, the IRS scrutinized

By 2017, the rate had plunged to 6.3% of those making at least $10 million.

But the next year, the rate increased, with 9.2% falling under the microscope in 2018.

By 2019, the rate for those making at least $10 million went to 10.2%.

Then, in 2020, it plummeted to 2.4%.

Changes in audit rates for those making $500,000 but less than $1 million have also swung over the years but haven't had the steep drop-off seen for $10 million-plus earners.

When it announced its strategic plan for eight fiscal years through 2031, the agency noted it has roughly 80,000 employees today — down

Mostly, it's the number of well-off and very rich Americans that has surged, thanks largely to the recent bull stock market. From 2020 to 2021 alone, the number of U.S. households with a net worth between $1 million and $5 million, not including the value of the primary residence,

Scott Bishop, the executive director of wealth solutions at Avidian Wealth Management in Houston, said the agency faced a major hurdle in putting its war chest to work: a

"So the real question is, are they going to find quality people to know what they're doing?" asked Bishop, who is both a certified financial planner and a certified public accountant.

Still, two things seem likely, he said.

First, the agency will find it easy to root out people who owe taxes on their digital payments. A law that went into effect this year requires cash apps and online marketplaces like PayPal and eBay to send tax documents to millions of Americans

Second, Bishop said, the IRS was likely to focus on banned tax dodges known as listed transactions. The agency has a

Said Bishop: "They're going to be looking at things that aren't even in a gray area anymore."