The number of certified financial planners at the industry's largest independent brokerages indicates how that channel of wealth management is changing, according to one expert.

CFPs — whose professional designation

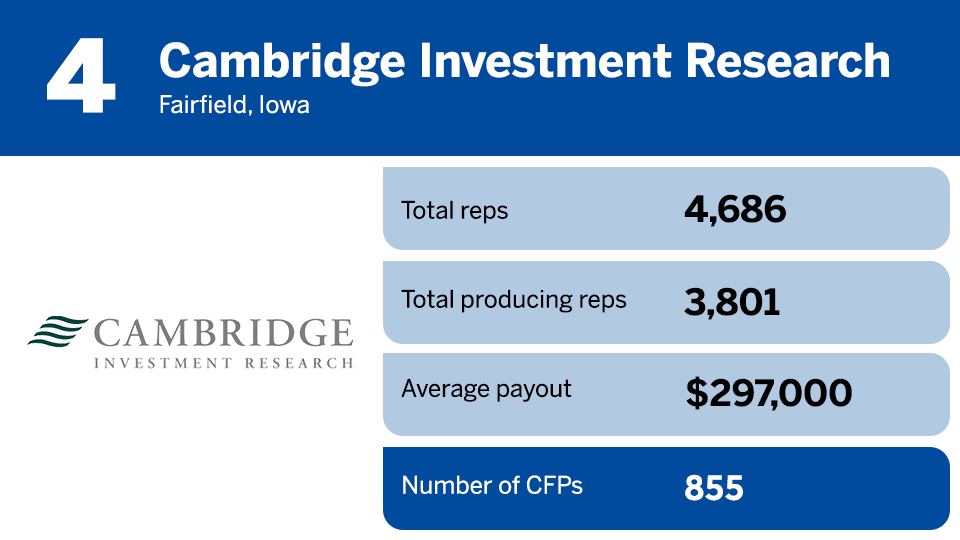

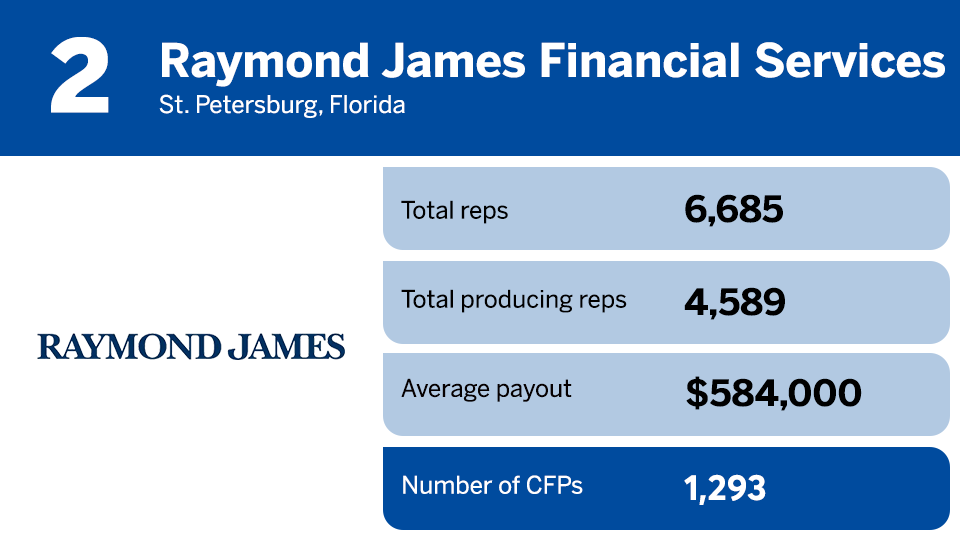

The group includes some big names in the industry such as Raymond James, Commonwealth Financial Network, Cambridge Investment Research, Northwestern Mutual, Kestra Financial and Atria Wealth Solutions. However, many of the largest firms in the channel, like LPL Financial, Ameriprise, Osaic, Cetera Financial Group and others, didn't disclose their number of CFPs, leaving them out of the rankings. The guidelines of the CFP mark can make

Regardless, recruiting and retaining a "stable, scalable" base of CFPs remains a key business prerogative for independent brokerages, "the big wirehouses and/or really anybody else who's serious about wealth management," Besheer said in an interview.

"We're seeing almost a second iteration of that transition now into what we refer to as holistic financial advice," he said. "CFPs are folks who really fit that bill, so it makes them very attractive."

Scroll down the slideshow below to see which independent brokerages have the most CFPs.

And see other IBD Elite 2023 coverage:

Cover story: What the heck is an OSJ? The 15 largest independent brokerages in wealth management The 10 firms with the largest percentage of women among their financial advisors Which independent brokerages have the largest RIAs? Deep dive into independent wealth manager data

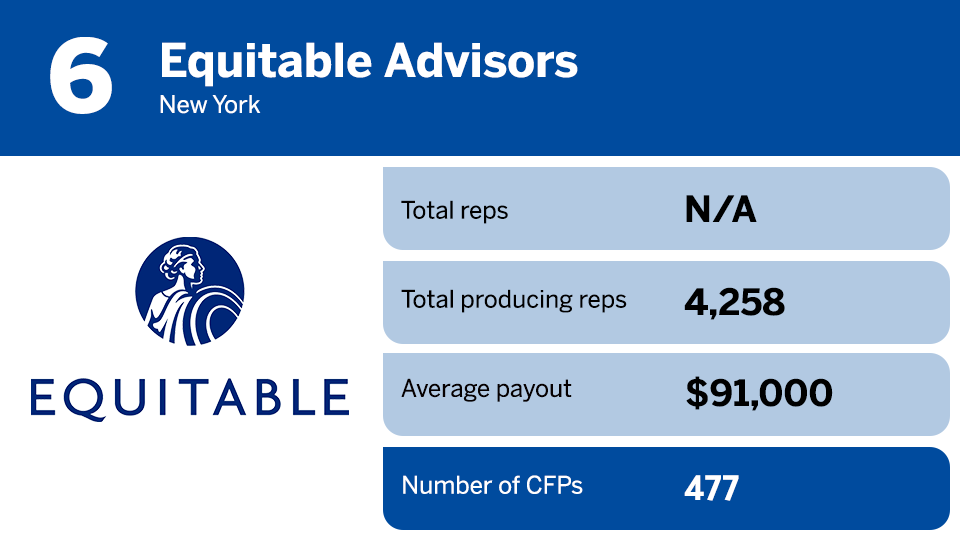

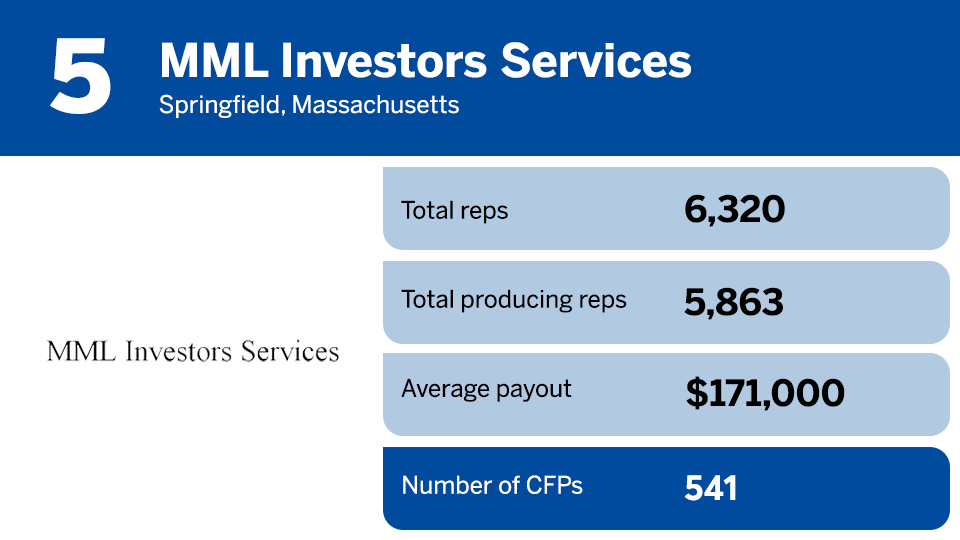

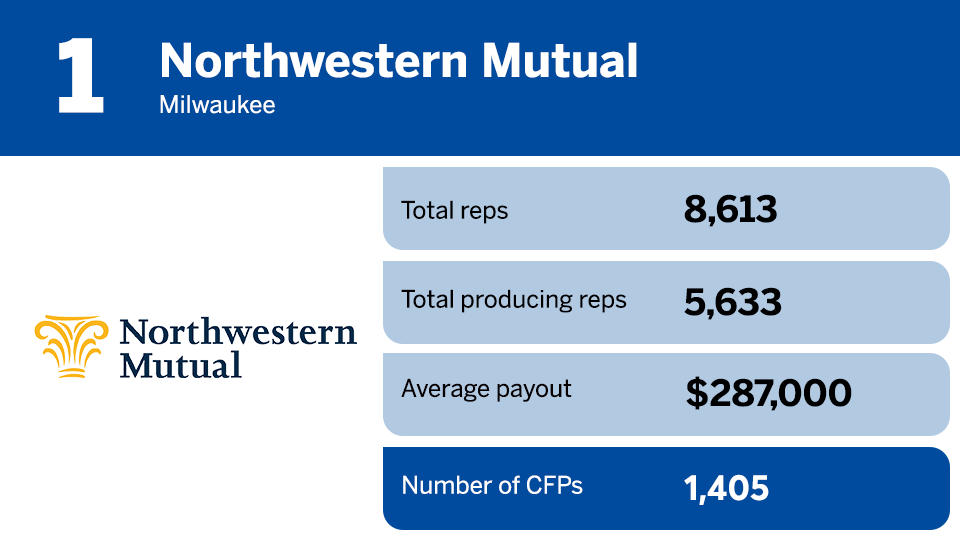

Notes: The companies are ranked below by the number of CFP holders among their financial advisors, as reported by the companies themselves. FP relies on each firm to state its metrics accurately.

Figures come from the end of 2022, and the firms' average payouts are rounded to the nearest thousand. "Total reps" is industry shorthand for the number of registered representatives at each brokerage, while "producing reps" is the number out of the group who generate revenue. In wealth management, the latter term is usually interchangeable with "financial advisor." The number of CFPs refers to the number of certified financial planners at each firm. The "average payout" comes from each firm's total payout to all producing reps divided by the number of producing reps.