Anyone suggesting that independent brokerages are losing business to registered investment advisors must not know how much cash brokers made last year.

The payday comes as wealth managers increasingly

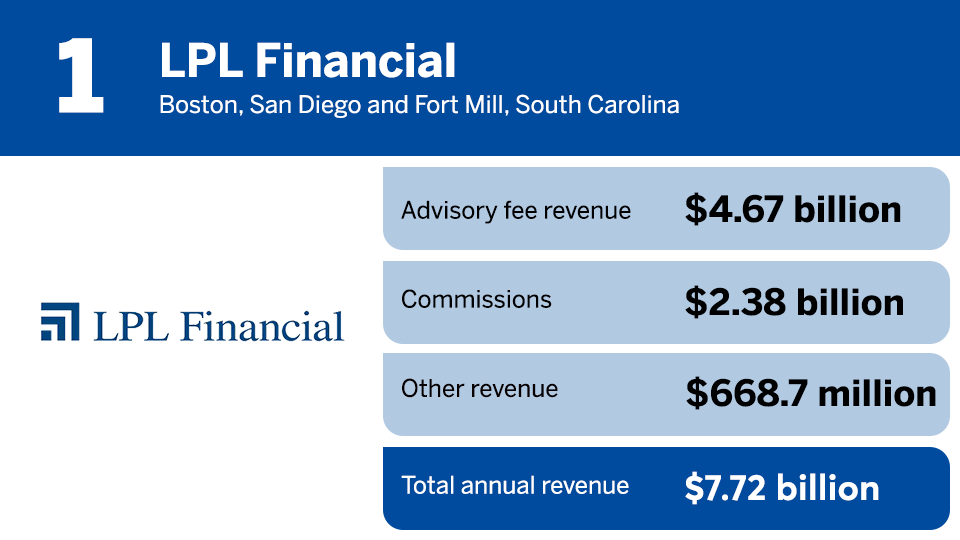

The paradigm, exemplified by LPL Financial, the Ameriprise franchise channel, Advisor Group and Raymond James Financial Services, blurs the lines between the wealth management industry's once-distinct models. Whether clients understand that setup remains an open question. Most financial advisors get it. RIAs must place a client's interests ahead of their own under the fiduciary duty, while brokerages are subject to a lower standard requiring them only to make recommendations in a client's "best interest."

The flow of advisors bringing their clients into RIAs

But not all of it.

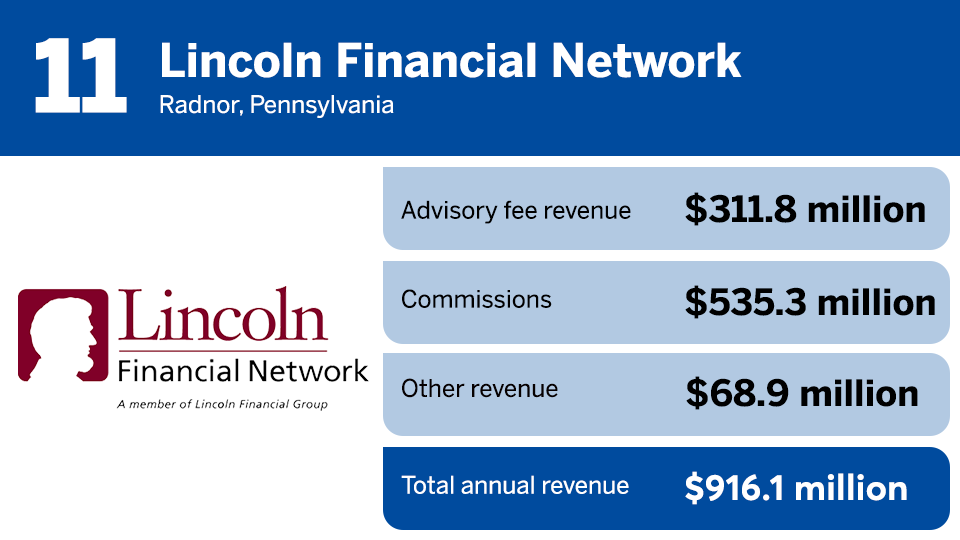

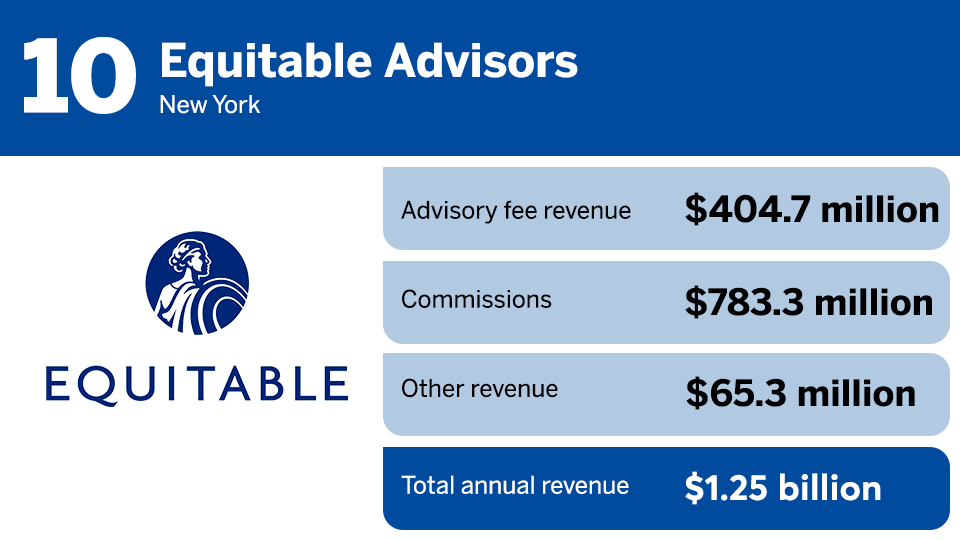

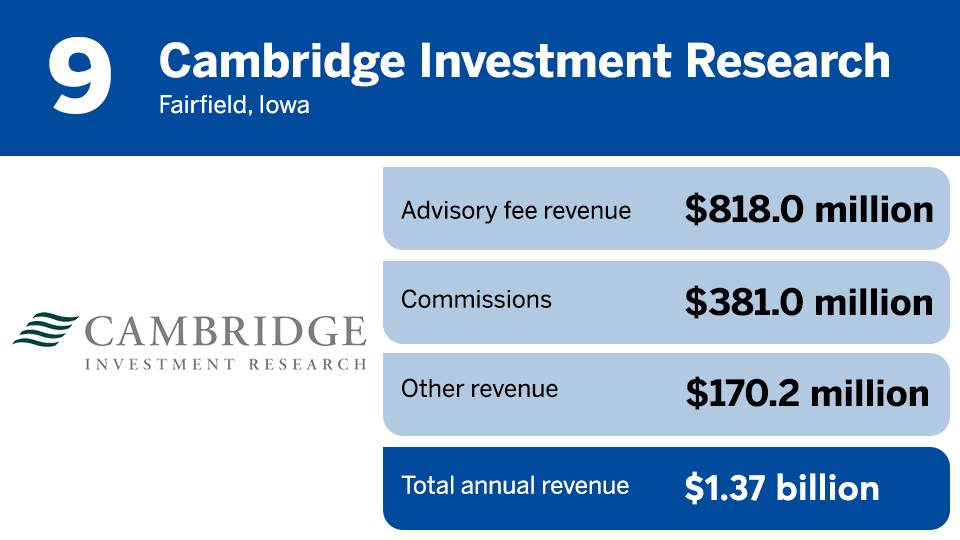

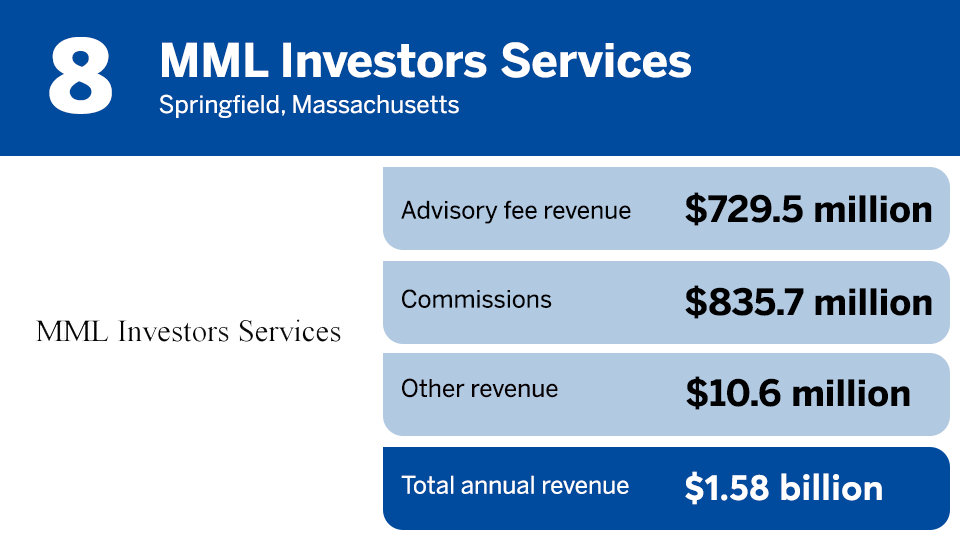

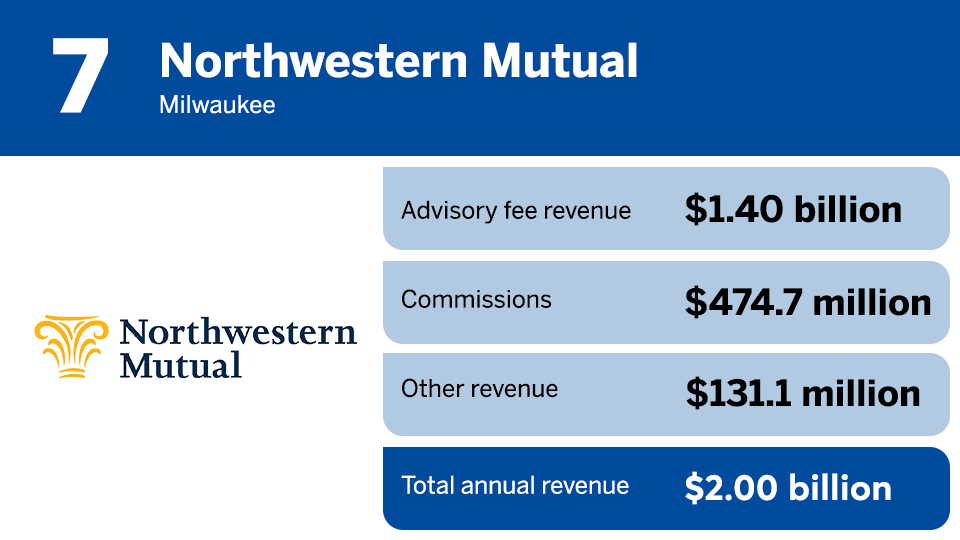

The 15 largest independent brokerages — wealth managers whose advisors are 1099 contractors as opposed to W-2 employees — grew by an average of 24% last year and generated more than $35 billion in combined revenue.

The expansion comes amid a competitive threat from RIA consolidator firms that often use a similar structure as independent brokerages but try to avoid the "broker" label. RIA consolidators are buying up advisory practices and enterprises at a massive scale, with many rollups to their networks coming

"I don't know if it's a misunderstanding or it's just a desire for their positioning in the marketplace," Wayne Bloom, CEO of giant independent wealth manager Commonwealth Financial Network, said in an interview earlier this year. When brokerages earn a commission, there's a "perceived" conflict of interest, even when a transaction is "the flat out best thing to do for the investor," Bloom said. "That's not a question that an investor may pose, but another one of the competitors vying for the business will have planted the seed with a potential client."

Bloom's firm and others that appear on the list below remain the workhorses of the independent brokerage channel, which prospered in 2021 amid acquisitions and higher gains in stock values.

Scroll down the slideshow to see the largest independent brokerages in wealth management in terms of their annual revenue. To read the IBD Elite cover story, "Brokerages are morphing, not going away,"

Notes: The companies are ranked below by their 2021 revenue, as reported by the companies themselves. FP relies on each firm to state their annual metrics accurately. The industry term "producing registered representative" refers to each firm's most accurate count of financial advisors using the firm as their brokerage or RIA. "Other revenue" means any other business besides sales commissions and advisory fees. Each metric is as of year-end 2021.