Making the switch from employee to retiree can be challenging, both

Fifty-seven percent of employees plan to work either full- or part-time into retirement age, according to the Transamerica Center for Retirement Studies. A survey from Bankrate found that 21% of baby boomers aged 58-76 work a side gig, making around $500 per month.

While the added

Read more:

While retirement is often viewed as an end point to a long career, it can actually be the start of a new and exciting era of personal rediscovery, says Ibrahim Taha, chief information officer at Roowaad, a business management platform.

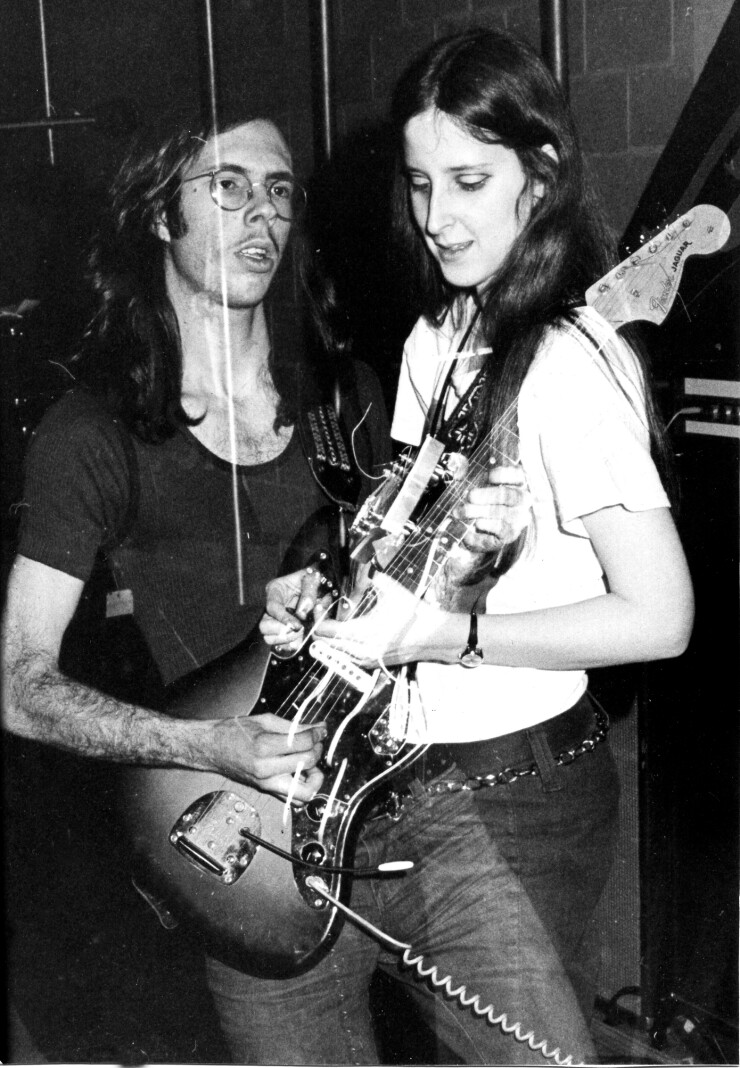

"Retirement is a golden opportunity to chase passions that were sidelined during the hustle of a career," Taha says. "Retirement isn't the end of work — it's the beginning of work that truly reflects one's passions and interests."

EBN spoke with three retirees on how they started new projects, rekindled old passions and contributed to their community through their side gigs.